Rates can be impacted by individuals financial, financial, personal and you can political points, which are unpredictable that will features a significant affect the prices out of precious metals. Concurrently, ETFs bring purchase will cost you which should be cautiously felt from the procedure for portfolio productions for example Bid/Inquire advances and profits. ETFs appear in of numerous differences to match a specific financing needs. A beginner get from time to time must hedge otherwise avoid downside risk in the a substantial profile, possibly one that has been received as the a keen genetics. A beginner can be similarly take advantage of regular silver power by to buy equipment of a famous gold ETF, for instance the SPDR Gold Faith (GLD), within the later june and you will closing-out the career immediately after a few away from days.

How to play with ETFs to construct my portfolio?

- Diversification and advantage allocation may well not lessen market risk otherwise death of dominant.

- Industry ETFs are accustomed turn inside and outside of sectors while in the economic time periods.

- In turn, this step exerts downwards stress on the cost of the newest ETF and you may upward stress on the cost of the underlying holds, until not any longer arbitrage can be made.

- You will want to look at the fund’s debts ratio and you may quote-ask bequeath as these make a difference your own efficiency.

- Various ETFs are available to investors to have earnings age group, conjecture, otherwise hedging chance inside a portfolio.

The new VIX steps the new inventory market’s expectations of volatility using S&P five-hundred list options. Volatility ETFs are usually put since the exchange instruments to possess hedging exposure or speculating for the changes in field volatility as opposed to enough time-name spending. Ahead of entertaining Fidelity otherwise people broker-specialist, you ought to gauge the full charge and you can charges of your own business and also the services provided.

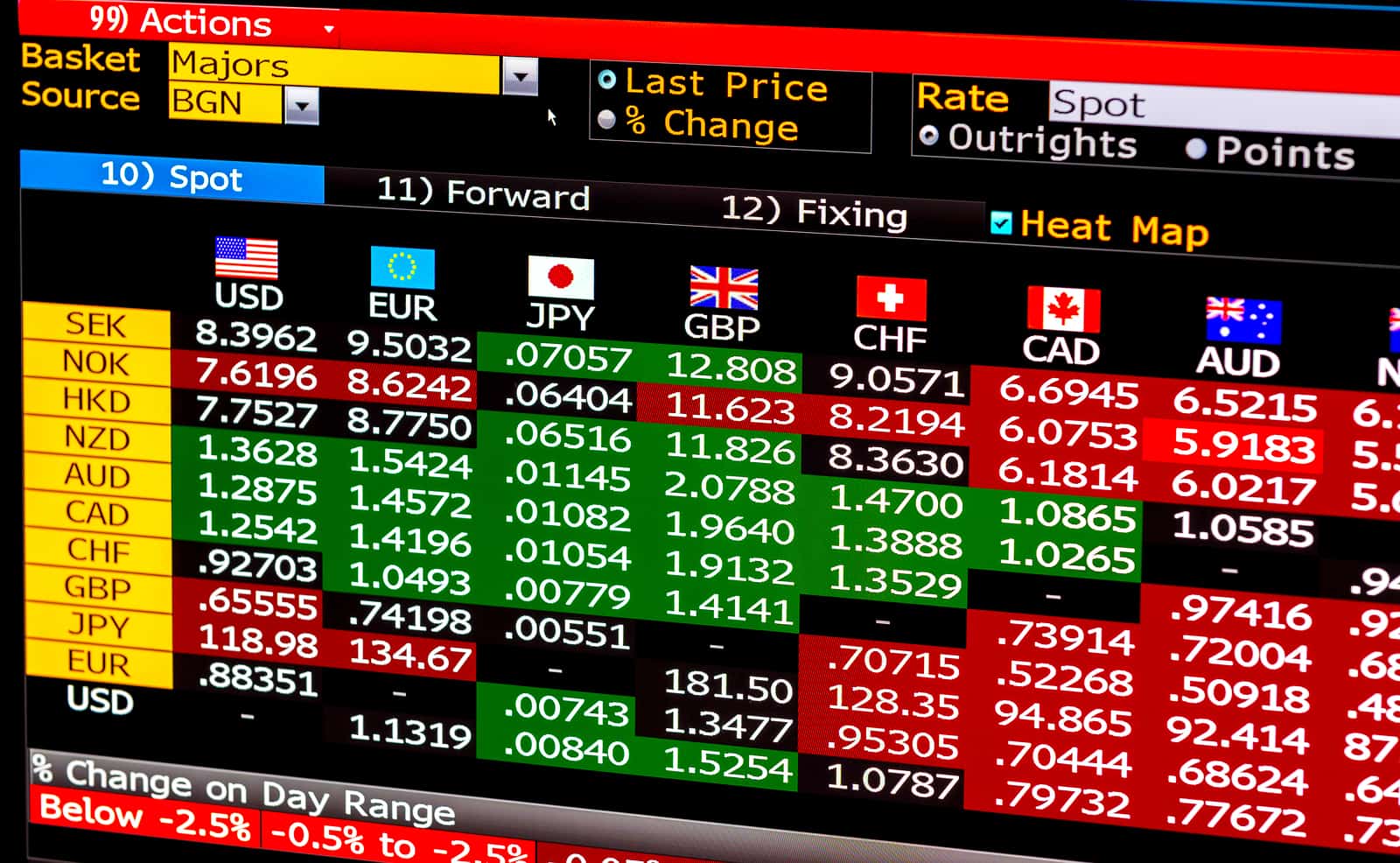

Such money properties do and work ETFs by the tracking particular indices, merchandise, otherwise asset categories while you are guaranteeing visibility, conformity, and you may inactive investment management to possess investors. That it possible liquidity can allow subscribers otherwise economic advisers to help you rapidly build changes if needed. Money ETFs provide subscribers a method to gain connection with overseas change areas with no complexities and you will hazards of in person trade currencies. By the investing an excellent currency ETF, members is also diversify the profiles and you can probably make the most of money movement without the need for official training or exchange solutions. When you’re a passive investor who is seeking match field productivity while maintaining will set you back at least, directory ETFs and you can list common money are what you are looking for. The main part of ETFs would be to tune the brand new efficiency from a specific index, and therefore techniques is named index record.

In terms of owning ETFs, a button element to look at ‘s the Total Bills Ratio (TER), and this represents the total cost of carrying an enthusiastic ETF for starters season. Such can cost you consist primarily away from management costs and extra money expenses, such trade costs, legal charge, auditor fees, and other working expenditures. Mutual fund usually require at least total initiate paying (including $step one,one hundred thousand or more). By contrast, while the ETFs can be purchased while the fractional offers, minimal expected is as little since the restrict set from the brokerage you happen to be having fun with. Can you imagine you can make best options that come with a common finance and you will combine it with the ones from an inventory?

Your investment options is going to be selected according to your wanted go back objectives and you will tolerance for chance. Such as, stock-dependent ETFs having the common amount of chance are a good for very long-name people because they can trip away small-name industry motion. As the ETF shares trade in the brand new open market, the new display rates would be determined by also provide and you may request. Therefore, the fresh display rates you may deviate on the NAV, doing novel selling and buying options from the exchange go out. They are able to tune industry indexes, such as the Nasdaq, or defense specific industry groups, including tech. Below are a few of your trick differences between ETFs, shared financing and you will stocks.

Advantages of Stock exchange-Exchanged Financing (ETFs)

The brand new strong exchangeability out of ETFs — the interest rate that they are exchanged — comes from the newest areas on what he is traded. ETFs exchange to the transfers and you will buyers can obtain or promote while in the the site:all-flesh.ru fresh change date, same as stocks. An expense ratio in the an enthusiastic ETF ‘s the yearly payment one to a trader pays to the new fund’s government company to have managing the finance. It’s shown as the a portion of the fund’s total property and you can is actually deducted on the fund’s possessions before every production are delivered to buyers. The expense proportion is an important grounds to take on when deciding on an enthusiastic ETF, since it individually has an effect on the overall production and gratification of one’s financing. ETF overall performance is myself linked to the root assets it track.

Girls Chat Money

It’s also far better pick or offer ETFs in the event the business on the hidden asset are unlock. Including, when you’re selling a keen ETF you to definitely songs Far eastern shares, put your requests in the event the Far eastern sharemarkets are unlock. Once you spend money on a keen ETF, you do not very own the underlying opportunities. You possess devices from the ETF plus the ETF merchant possess the fresh offers or property. ETFs provides transformed using through providing independency, reduced can cost you, and diversity. Whether you’re a skilled trader or simply carrying out, understanding what is ETF inside the India and its various classes are critical for and then make informed choices.

Are you on track in order to meet your financial requirements?

An authorized new member — usually an enormous financial institution such as Lender from The usa otherwise J.P. Morgan — sales the root property, as well as the ETF will then be permitted to sell certain or all of its offers to your a stock game. Buyers purchase an item of the new finance but don’t in fact very own the underlying possessions. Even if will cost you are very different because of the financing, ETFs routinely have down charges in contrast to actively treated shared finance.

Most wider-centered ETFs exchange within dos% of your money’s NAV, although this spread you will expand within the episodes from business volatility. The fresh superior or dismiss is also more critical for much more narrowly centered ETFs. Know the way your specific ETF functions — ETFs are sold because of the prospectus, that provides important info, like the financing’s investment expectations. Demand the newest prospectus from your own financial advisor and read it totally prior to making a good investment choice. Assess your financial wants — Understand the fund’s investment means and you may view if it is right for you. The procedure all of the begins with an ETF mentor, usually a finance movie director, just who creates a good investment management means considering discovering some ties as well as their overall performance.

Including, if you were trying to find putting on exposure to particular European carries from Austrian industry, you could potentially take into account the iShares MSCI Austrian Index fund (EWO). These types of work on brings from major indexes for example SPY, sectors for example medical care, or render returns. They are able to along with love to buy companies with different industry capitalization or particular themes, such as fake intelligence, that may cover businesses across other groups.

Which are the great things about leveraged inverse ETFs?

- You may also benefit due to returns, which are servings of your own profits away from businesses regarding the fund.

- The fresh using suggestions provided on this page is for educational objectives merely.

- ETF results try in person connected to the root assets it tune.

- Inside January 2024, the newest SEC relented and greeting the original put bitcoin (BTCUSD) ETFs to begin exchange.

However, it’s important to understand the dangers involved and employ him or her meticulously. Buyers seeking to gain experience of global segments does very thanks to international field ETFs. This type of ETFs tune indicator from international segments, for instance the Nikkei 225 within the The japanese and/or Hang Seng List inside the Hong-kong. They offer a convenient solution to broaden profiles and you will participate in the development from global areas. Andrea Coombes features 20+ numerous years of sense permitting anyone reach its financial desires. Their personal fund articles have starred in the new Wall Highway Journal, United states Now, MarketWatch, Forbes, and other books, and you will this woman is shared the girl systems on the CBS, NPR, “Opportunities,” and a lot more.

ETFs offer access to an array of money options, covering a broad set of advantage groups, circles and you may geographies. You’ve probably found that staying charge reduced is a huge rider out of profitable investing. Even though that’s extremely important, fees could be far more bad for a lot of time-term output than simply financing management fees. Directory ETFs generally seek to song spiders which might be comprised of of a lot private bonds, assisting to bequeath the chance and reduce the newest feeling out of rates swings in almost any one security. Although this will not eliminate risk completely, the fresh varied framework of ETFs gets the potential to help the risk-modified get back of your own profile.

Simultaneously, investors buy and sell ETF shares with other traders on the a keen change. As a result, the new ETF director doesn’t have to market holdings — potentially performing financing development — to fulfill individual redemptions. Common fund shareholders, simultaneously, get shares straight from the new money. The newest finance movie director must have a tendency to offer fund bonds to prize redemptions, probably triggering financing growth which in turn drip down seriously to all the buyers in the finance. Delivering traders a simpler, more efficient way to availableness the newest economic places have almost certainly assisted ETFs grow in the dominance – and you will property under management — as the first ETFs released in the early 1990’s.